By Sam Carnes, Queens University News Service

Evictions in Mecklenburg County have returned to pre-pandemic levels and are now averaging 2,500 per month, a rate that keeps Charlotte among the nation’s top cities for evictions, say attorneys with legal aid organizations that represent tenants.

The most recent data from the North Carolina Administrative Office of the Courts indicates a level of 30,000 eviction cases annually, said Isaac Sturgill, an attorney specializing in housing with Legal Aid of North Carolina. The Eviction Lab, a project of Princeton University, ranks Charlotte sixth in the nation for evictions. A 2017 UNC Charlotte Urban Institute report indicated that 28,471 eviction complaints were filed in the 2015-16 fiscal year.

These rates have human consequences, said Toussaint Romain, who recently became chief executive officer for the Charlotte Center for Legal Advocacy. Romain recalls visiting Charlotte’s tent city of homeless people in August 2020.

“We really saw whole families, like a mom and a dad and three babies who were living in a tent for the first time in their lives,” Romain said. “They were there because they worked in the service industry. And when COVID happened, shut all that down, and they were kicked out of their places because of not paying rent. … and I don’t know if you’ve ever seen a 2-year-old baby, you know, that was homeless.”

Sturgill and Romain are two of dozens of attorneys who represent people experiencing the worst consequences of the rising cost of housing in Mecklenburg County. Without a course correction in the cost of housing, these lawyers say, Charlotte risks becoming a city like San Francisco.

“Charlotte is on track to be a city for white-collar professionals that make a certain income, [with] an underclass of people who serve the professional class,” said Ismaail Qaiyim, who founded the Queen City Community Law Firm and works with the Housing Justice Coalition CLT and the Latin American Coalition.

Read more: Charlotte Journalism Collaborative

Tag: Evictions

Eviction Assistance and Resources

The eviction moratorium has ended, but there are still legal and financial resources available.

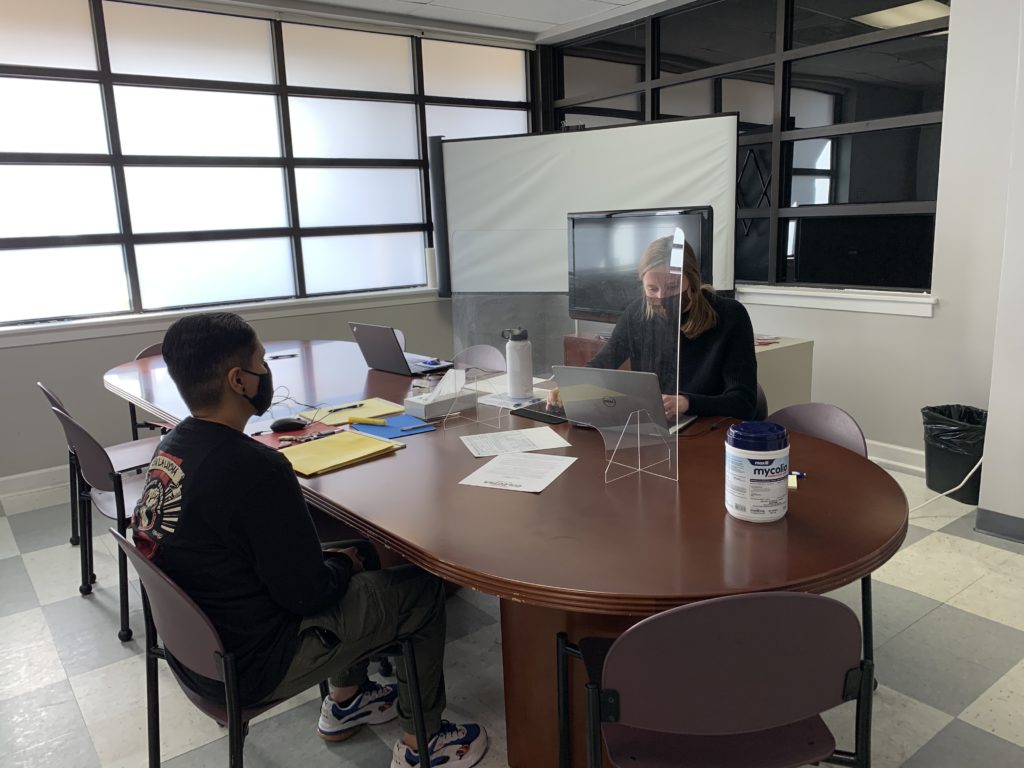

We brought together Juan Hernandez, Staff Attorney, Charlotte Center for Legal Advocacy and Erin Barbee, Senior Vice President Programs & Fund Development, DreamKey Partners, to answer common questions and share helpful information for community members facing eviction.

Find a copy of the presentation and links to key resources here.

Action Alert: Protections for Motel Renters Threatened as Bill Advances in NC Senate

The fight to protect our community’s most vulnerable renters continues.

Thanks to your advocacy, a measure to take away tenants’ rights from motel renters was taken out of a regulatory reform bill in the N.C. General Assembly. But it has become a standalone bill moving forward in the N.C. Senate as HB 352 Hotel Safety Issues.

The bill is now before the Senate Judiciary Committee. If passed, HB 352 will drastically change the way people who live in motels are treated when it comes their rights as renters and significantly exacerbate the state’s affordable housing crisis.

Contact our Senate Judiciary Committee Members and urge them to reject this legislation

A reminder of what’s in the legislation:

The legitimate purpose of HB 352 is for the faster removal of criminal actors who reside at motels, an issue exposed after eviction moratoriums prevented motel owners from quickly removing residents during the COVID-19 pandemic.

However, the legislation would also eliminate tenant protections recognized by the N.C. Court of Appeals in Baker v. Rushing, a case litigated by Charlotte Center for Legal Advocacy under its old name, Legal Services of Southern Piedmont.

HB 352 would automatically re-classify all motel tenants as “transient guests” for the first three months of their leases regardless of their record of rental payments and good conduct. Doing so gives motel landlords unlimited power to punish and evict tenants who complain about living conditions such as rodent infestation, inoperable plumbing, HVAC issues, or noise.

Thanks to our efforts 30 years ago, N.C. law recognizes that motel residents, who are not tourists with a regular home elsewhere, have the same rights as tenants in conventional homes and apartments.

Those rights include a habitable dwelling with working plumbing, heat, and wiring along with the due process of a fair trial in cases of eviction.

Why it’s a problem:

Thousands of N.C. families rely on motels as the housing of last resort to avoid homelessness, especially in Charlotte, where there is an extreme shortage of affordable housing.

The pandemic has forced more families into this situation as people lost their jobs and could no longer afford traditional housing.

HB 352 would enable motel owners to evict already struggling residents, including children, and leave them with little to no chance of finding safe housing elsewhere.

For those with an eviction on their record, getting approved to rent an affordable place to live is extremely difficult.

HB 352 would needlessly increase our homeless population and strain public resources. In the event of another public health crisis, these residents will not be protected by measures implemented to ensure safe shelter just because they do not have conventional housing.

Further, the legitimate issue this bill is targeting can be handled through education on current N.C. law, which already protects landlords by permitting expedited evictions through the court system for criminal actors.

This legislation will further drive our state into crisis when it comes access to affordable housing.

As an advocate for low-income people, Charlotte Center for Legal Advocacy urges our representatives to reject this legislation and protect tenants’ rights for all North Carolinians.

What you can do

Contact members of the Senate Judiciary Committee and HB 352 sponsors. Tell them long-term motel residents have the same rights as traditional tenants and this harmful legislation should not become law.

HB 352’s sponsors are:

Rep. John R. Bradford, III

Rep. Timothy D. Moffitt

Rep. William O. Richardson

Rep. Jerry Carter

Rep. Chris Humphrey

Rep. Frank Iler

Rep. Jake Johnson

Rep. Jeffrey C. McNeely

Rep. Phil Shepard

Rep. John Szoka

Rep. Michael H. Wray

Action Alert: NC Bill Removes Protections for Motel Renters

The North Carolina General Assembly is considering legislation that would take rights away from some of the most vulnerable renters in our community.

HB 366 is a Regulatory Reform Bill with a provision that would drastically change the way people who live in motels are treated when it comes their rights as renters and significantly exacerbate the state’s affordable housing crisis.

The bill will be considered for advancement by the N.C. Senate’s Agriculture, Energy and Environment Committee at 10 a.m. Tuesday, June 29.

The legitimate purpose of HB 366 is for the faster removal of criminal actors who reside at motels, an issue exposed after eviction moratoriums prevented motel owners from removing residents during the COVID-19 pandemic.

However, the legislation would also have the unintended consequence of forcing our most vulnerable community members into homelessness by eliminating tenant protections recognized by the N.C. Court of Appeals in Baker v. Rushing, a case litigated by Charlotte Center for Legal Advocacy under its old name, Legal Services of Southern Piedmont.

Thousands of N.C. families rely on motels as the housing of last resort to avoid homelessness, especially in Charlotte where there is an extreme shortage of affordable housing.

The pandemic has forced more families into this situation as people lost their jobs and could no longer afford traditional housing.

Thanks to our efforts 30 years ago, N.C. law recognizes that motel residents, who are not tourists with a regular home elsewhere, have the same rights as tenants in conventional homes and apartments.

Those rights include a habitable dwelling with working plumbing, heat, and wiring along with the due process of a fair trial in cases of eviction.

HB 366 would automatically re-classify all motel tenants as “transient guests” for the first three months of their leases regardless of their record of rental payments and good conduct. Doing so gives motel landlords unlimited power to punish and evict tenants who complain about living conditions such as rodent infestation, inoperable plumbing, HVAC issues, or noise.

For those with an eviction on their record, getting approved to rent an affordable place to live is extremely difficult. HB 366 would enable motel owners to evict already struggling residents, including children, and leave them with little to no chance of finding safe housing elsewhere.

This practice will needlessly increase our homeless population and strain public resources. And in the event of another public health crisis, these residents will not be protected by measures implemented to ensure safe shelter just because they do not have conventional housing.

Further, the legitimate issue this bill is targeting can be handled through education on current N.C. law, which already protects landlords by permitting expedited evictions through the court system for criminal actors.

If this provision remains in the legislation, it will only drive our state further into crisis when it comes access to affordable housing.

As an advocate for low-income people, Charlotte Center for Legal Advocacy urges the bill’s sponsors and the Senate Agriculture, Energy and Environment Committee to remove this provision from the legislation and protect tenants’ rights for all North Carolinians.

What you can do

Contact members of the Senate Agriculture, Energy and Environment Committee and HB 366 sponsors. Tell them long-term motel residents have the same rights as traditional tenants and this harmful measure should not become law. The Agriculture, Energy and Environment Committee will meet next Tuesday, June 29, at 10 a.m. to consider this bill.

HB 366’s sponsors are:

Rep. Larry Yarborough

Rep. John R. Bradford, III

Rep. Timothy D. Moffitt

Rep. Dennis Riddell

Rep. Jerry Carter

Rep. Phil Shepard

Learn about this this systemic problem in our community to understand how HB 366 will impact our neighbors:

WSOC-TV – Charlotte Motel Threatening to Evict Some People Who Live There

WFAE – Finding Home: Long-Term Hotel Residents Face Eviction Threats

This issue is not limited to Charlotte or North Carolina. The expansion of motels as weekly rental options is a systemic problem symptomatic of our country’s affordable housing crisis. Removing landlord-tenant protections for those who have no other options for housing is not the solution.

Learn more about the trend and how people get pushed out of our traditional housing system:

New York Times Magazine – When No Landlord Will Rent to You, Where Do You Go?

American Rescue Plan Offers Relief

Third COVID-19 Relief Package Passes as Pandemic Marks One Year

On March 11, 2021, President Biden signed the American Rescue Plan into law as the largest and most recent COVID-19 relief package extending $1.9 trillion dollars in aid to families, businesses, nonprofits, and states. This third round of aid comes as Charlotte Center for Legal Advocacy marks a full year fighting to support families under the pandemic.

And our work is far from done.

As we learn more about how the plan’s programs and funding will be implemented, we will update our website and social media accordingly. Please contact us at the appropriate numbers below if you or your family are struggling and need assistance.

This list is not exhaustive, and the bill contains programs and funding not listed here.

Here is what we know so far:

ECONOMIC IMPACT PAYMENTS (STIMULUS CHECKS) AND TAX CREDITS

The American Rescue Plan includes a third round of tax-free economic stimulus payments.

In this version, the maximum payment is $1,400 per qualified individual or $2,800 for a couple. In addition, payments are now available for all dependents, including children in college and elderly relatives. Children of mixed-immigration status families with valid social security numbers are also eligible for the stimulus payments

The additional amount for dependents is significantly higher – $1,400 per eligible dependent.

As before, economic stimulus payments are phased out, based on adjusted gross income. However, the upper threshold is reduced from $100,000 of adjusted gross income to $80,000 for single filers and from $200,000 down to $160,000 for joint filers. Payments for dependents are also phased out under these thresholds.

The IRS expects to begin sending out payments in March.

Third Economic Stimulus Payments Will Be Based on 2019 or 2020 Tax Returns:

The American Rescue Plan provides that if your 2020 tax return is not filed and processed by the time the IRS starts processing your third stimulus payment, the tax agency will use information from your 2019 tax return. If your 2020 return is already filed and processed when the IRS is ready to send your payment, then your stimulus check eligibility and amount will be based on information from your 2020 return.

If your 2020 return is filed and/or processed after the IRS sends you a stimulus check, but before July 15, 2021 (or September 1 if the April 15 filing deadline is pushed back), the IRS will send you a second payment for the difference between what your payment should have been if based on your 2020 return and the payment sent based on your 2019 return.

If you have questions about the economic impact payments, contact a tax advocate at 980-202-7329

Child Support Won’t Be Taken Out of Stimulus Checks:

As with second-round checks, third stimulus checks will not be reduced to pay child support arrears.

Wage Garnishment:

The COVID-Related Tax Relief Act prevented garnishment of second-round stimulus checks by creditors or debt collectors. They could not be lost in bankruptcy proceedings, either. The IRS also had to encode direct deposit second-round payments so that banks knew they could not be garnished. This is in contrast with the CARES Act, which did not provide similar protections for first-round payments. These protections are included for the third stimulus payment as well.

Under the American Rescue Plan, payments will be protected from reduction or offset to pay federal taxes, state income taxes, debts owed to federal agencies, and unemployment compensation debts. (As well as child support, as was discussed above.) However, as with first-round checks under the CARES Act, there will be no additional protections against garnishment by private creditors or debt collectors for third-round payments.

Earned Income Credit

The American Rescue Plan expands the Earned Income Tax Credit for 2021, raising the maximum credit for childless adults from roughly $530 to close to $1,500, while also increasing the income limit for the credit from about $16,000 to about $21,000, and expanding the age range that is eligible by eliminating the age cap for older workers.

The American Rescue Plan includes changes to the Child Tax Credit (CTC). Under current law, the CTC is equal to $2,000 for each qualified child under age 17 who resides with you for at least six months of the year. Up to $1,400 of this amount is refundable, but the credit begins to phase out at $200,000 of adjusted gross income for single filers and $400,000 for joint filers.

This credit will not go into effect until the 2021 tax year, which will be filed in Spring 2022.

The new law provides the following revisions for the 2021 tax year:

- An increase in the CTC to $3,600 per qualified child under age six and $3,000 for a child up to age 17.

- An additional $500 credit is available for dependent children in college who are under age 24.

- The credit is fully refundable.

- The phaseout begins at lower levels of $75,000 of adjusted gross income for single filers and $150,000 for joint filers. But many higher-income families can still claim the $2,000 credit subject to the prior phaseout rules.

Finally, the IRS will make advance payments of the credit, beginning in July. The exact logistics of that process are still being worked out.

The American Rescue Plan substantially increases the Dependent Care Credit for many moderate-to-high income taxpayers.

Presently, the Dependent Care Credit is available for qualified expenses of caring for children under age 13 to allow you (and your spouse, if married) to be gainfully employed. The credit is generally equal to 20 percent of the first $3,000 of qualified expenses for one child and $6,000 for two or more children. Thus, the maximum credits are $600 and $1,200, respectively.

The new law enhances the Dependent Care Credit for the 2021 tax year.

It increases the maximum credit to $4,000 for one child and $8,000 for two or more children for households with an adjusted gross income of up to $125,000. But the credit will be reduced below 20% for those with an adjusted gross income of more than $400,000. Finally, the credit for 2021 is refundable.

This credit will not go into effect until the 2021 tax year, which will be filed in Spring 2022.

Student Loan Forgiveness Credit

If a debt is forgiven or cancelled, it generally results in taxable income to the debtor. However, in limited cases, debts of student loans that are forgiven may be exempt from tax.

The American Rescue Plan effectively creates a tax exemption for student loans made, insured or guaranteed by the federal or state governments, as well as loans from private lenders and educational institutions. This does not apply, however, to loans that are discharged in exchange for services rendered.

This provision is effective beginning with the 2021 tax year and lasts through the 2025 tax year but could be extended or made permanent.

Taxes on Unemployment Benefits

The American Rescue Plan exempts from federal income tax up to $10,200 of unemployment benefits received in 2020 by a family with an adjusted gross income under $150,000. Normally, those benefits would be fully taxable. This tax break is intended to help taxpayers who might be blindsided by an unexpected tax bill on their 2020 returns.

Please note that states can still tax unemployment benefits as income.

UNEMPLOYMENT INSURANCE

The American Rescue Plan extends the CARES Act’s unemployment insurance expansion through Sept. 6, 2021. Specifically, this act:

Provides an additional $300 per week to on top of what beneficiaries are getting through their state unemployment insurance program.

The first $10,200 of jobless benefits accrued in 2020 would be non-taxable for households with incomes under $150,000. Please note that states can still tax unemployment benefits as income.

Extends the Pandemic Unemployment Assistance (PUA) program, which provides continued unemployment assistance to the self-employed, freelancers, gig workers, part-time workers and other individuals in non-traditional employment. It also increases the number of weeks of PUA benefits an individual may claim, from 50 to 79;

Extends the Pandemic Emergency Unemployment Compensation (PEUC) program, providing additional weeks of federally-funded benefits to workers who have exhausted their regular state unemployment benefits. It also increases the weeks of PEUC benefits an individual may claim, from 24 to 53.

Apply for unemployment at the Department of Employment Security website or call 1-888-737-0259.

EMERGENCY MORTGAGE, RENTAL AND UTILITY SERVICES

The plan provides $25 billion for emergency rental assistance, including $5 billion for emergency housing vouchers for people experiencing homelessness, survivors of domestic violence and victims of human trafficking.

The plan also sends roughly $20 billion to state and local governments to help low-income households cover back rent, rent assistance and utility bills. There is $4.5 billion for the Low-Income Home Energy Assistance Program (LIHEAP) to help families with home heating and cooling costs.

You can apply for utility assistance through the Low-Income Home Energy Assistance Program or RAMP Charlotte.

FOOD AND NUTRITIONAL ASSISTANCE

Millions of families across the country are struggling to put food on the table. This act addresses food insecurity by:

- Extending the current 15 percent increase in food stamp benefits through September 2021, instead of letting it expire at the end of June.

- Providing $880 million for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) to help increase participation and temporarily improve benefits

- Allowing states to continue the Pandemic-EBT (PEBT) program through summer for families with children who qualify for free and reduced meals in school. The program gives families financial assistance to replace the meals the kids would have received if schools had not been closed due to COVID-19.

If you need assistance with applying for SNAP, PEBT, or other public benefits, contact our Family Support and Healthcare team at 704-376-1600.

CHILD CARE

The plan includes a number of provisions to increase access to child care, including an additional $15 billion through Sept. 30, 2021 for the Child Care and Development Block Grant.

It does not reinstate mandatory paid family and sick leave approved in the CARES Act. But it will continue to provide tax credits to employers who voluntarily choose to offer the benefit through October 1, 2021.

STUDENT LOANS

Many federal student loans are continuing in forbearance, which is scheduled to end October 1. If student loan debt is forgiven after December 31, 2020, and before January 1, 2026, the cancelled debt won’t be taxed.

FINANCIAL ASSISTANCE FOR HEALTH INSURANCE

More Help to Pay for Health Coverage under the Affordable Care Act (ACA):

The American Rescue Plan provides financial assistance to help consumers get health insurance through the Federal Health Insurance Marketplace under the Affordable Care Act (ACA or Obamacare).

Under the plan, consumers can receive increased premium tax credits to pay for coverage in 2021 and 2022, eliminating or reducing premiums for millions of current Marketplace enrollees to ensure that no one on the exchange spends more than 8.5 percent of their income on coverage premiums, regardless of their income level.

This reduces the current 9.83 percent limit for people with income of 300 to 400 percent of the poverty line and establishes a new premium cap for Marketplace enrollees with higher incomes.

Under the bill, people with income below 150 percent of the poverty line (about $19,000 for a single person and $39,000 for a family of four) would pay no premiums for a benchmark plan, after accounting for premium tax credits. Families who make more will pay a fixed percentage of income toward Marketplace health coverage.

This will significantly reduce premiums for people who are currently eligible for financial help by increasing their premium tax credits. For example:

- A single individual making $18,000 would pay zero net premium rather than $54 per month (3.6 percent of income) and would qualify for the most generous subsidies for deductibles and other cost-sharing amounts.

- A single individual making $30,000 would pay $85 rather than $195 per month in premiums (3.4 instead of 7.8 percent of income) and would qualify for a plan with reduced deductibles and other cost-sharing amounts. Or, with the bigger subsidy, the same person could opt to buy a gold plan with lower cost-sharing charges for $115 per month.

- A family of four making $50,000 would pay $67 rather than $252 per month in premiums for benchmark coverage (1.6 instead of 6.0 percent of their income) and would qualify for generous cost-sharing reductions.

- A family of four making $75,000 would pay $340 rather than $588 per month in premiums for benchmark coverage (5.4 instead of 9.4 percent of their income). A typical family could purchase a gold plan with lower deductibles and other cost sharing for about $440 per month (roughly 7 percent of income).

An open enrollment period will begin November 1 for anyone who wants to sign up for health insurance or change their current Marketplace plan.

Streamlines process to qualify for ACA subsidies

The package also enhances premium tax credits (financial assistance) for people who receive unemployment benefits in 2021 by setting their Marketplace eligibility at a projected income levels that guarantee they will get the most generous premium tax credits under an ACA Marketplace plan, regardless of what their actual year-end income ultimately is. This includes people who have previously found themselves in the Medicaid gap.

The package also eliminates the need to repay ACA subsidies from 2020. Some people lost their jobs early last year but later got new ones and saw higher earnings than they had expected. Others worked additional hours or received bonus pay as essential workers. Under this plan, low- and moderate-income families are exempt from having to repay the premium tax credit (financial assistance) they received in 2020.

COBRA premiums covered

Under the relief plan, the government would pay the entire COBRA premium from April 1 through Sept. 30, 2021 for those who lost employer-based coverage due to lay-offs or working reduced hours.

A person who qualifies for new, employer-based health insurance someplace else before Sept. 30 would lose eligibility for the no-cost COBRA coverage. Someone who leaves a job voluntarily would not be eligible either.

Incentivizes States to Expand Medicaid Eligibility

The plan incentivizes states that still have not expanded their Medicaid programs (like North Carolina) to expand eligibility for adults by increasing matching federal funds (raising the state’s Federal Medical Assistance Percentage by 5 percentage points) over two years.

In North Carolina, this means more than 500,000 residents in the Medicaid gap (those who currently make too little to receive financial help for Marketplace coverage and make too much to qualify for Medicaid) would finally have access to coverage and the health care at a time when they need it most.

This incentive would pump $2.4 billion new federal dollars into the state in just two years if N.C. is willing to take advantage of it.

States choosing to expand would be required to maintain Medicaid coverage levels to receive the increase, including the newly established requirement to cover COVID-19 vaccine and treatment (see below).

Covers COVID Testing and Treatment

The plan also requires Medicaid and Childrens Health Insurance Program (CHIP) coverage of COVID-19 vaccines and treatment without beneficiary cost sharing. Vaccines and vaccine administration costs would be matched at 100 percent until one year after the end of the Pandemic Health Emergency. States also would have the option to provide coverage to the uninsured for COVID-19 vaccines and treatment without cost sharing at 100 percent. Everyone should have access to COVID testing, treatment, and vaccinations regardless of income, insurance, or immigration status.

Expands Access to Postpartum and Child Health Care

The plan also gives states five years to extend their Medicaid and Children’s Health Insurance Program (CHIP) eligibility to include pregnant individuals for 12 months postpartum. States choosing this option must provide the full Medicaid benefit for pregnant and postpartum individuals during the 12-month postpartum period.

Increased Funds for Home and Community-Based Services

The plan provides temporary one-year FMAP increase to improve home-and-community-based-services as well as FMAP increases for services provided through the Urban Indian Organizations and Native Hawaiian Health Care Systems. The bill also would provide funding to states for the creation of nursing home strike teams to assist in managing COVID-19 outbreaks when they occur.

Option to create new Medicaid Program for Crisis Intervention Services

The plan gives states five years to creates a new optional Medicaid covered service for adults by offering mobile crisis intervention services for adults experiencing a mental health or substance use disorder crisis.

Have questions about how this plan impacts your coverage options or access to health care? Contact our Family Support and Health Care team by calling 704-376-1600

Responding to Crisis: Marking One Year of COVID-19

Last March, few imagined that our community would still be grappling with the coronavirus pandemic a year later.

In many ways it seems the pandemic is nearing an end after this year of hardship and loss: vaccines for the virus are increasingly available, and cases have dropped to a point where North Carolina is easing activity restrictions.

But we are only just beginning to understand the extent to which this virus has driven our neighbors to the margins of safety, economic security and family stability, laying bare the extreme inequities that have long existed in our community.

Charlotte Center for Legal Advocacy has spent the last year fighting for our community’s most vulnerable residents as COVID-19 upended daily life.

As we pass this milestone, we take stock of just how much we’ve fought to advance our mission of pursuing justice this past year.

It’s work we do every day and have always done in our 50+ years of service. But COVID-19 has cast a glaring spotlight on the importance of our mission.

Pursuing justice: It’s fairness under the law. It’s equal access. It’s meeting basic needs. And it’s making sure our neighbors are equipped to endure any crisis life throws their way, including a global pandemic.

Today and every day, we continue this hard, necessary work until our community is a stronger, more just and equitable place for ALL.

Over the past year we:

- Addressed immediate issues related to agency closures in our local Department of Social Services (DSS), allowing for remote application for benefits and limiting terminations and state unemployment insurance systems to tackle issues stalling federal unemployment benefits.

- Helped clients navigate individual economic stimulus payments and unemployment insurance programs.

- Prevented illegal evictions and kept vulnerable populations safely housed.

- Responded to critical needs for protective orders and intervention due to a sharp increase in domestic violence incidents while our courts were operating on a limited capacity.

- Monitored the changes in Medicaid, food stamps and other assistance programs to ensure coverage is not disrupted for those who need them in our community.

- Advocated for language and technological access on administrative applications for health, food and income benefits to ensure all who were entitled to assistance could receive it.

- Assisted people who have lost their jobs and/or health insurance navigate Affordable Care Act health coverage options and Special Enrollment Periods (SEPs).

- Ensured members of our community are not falling victim to COVID-19 related scams and losing their income.

- Helped immigrant families understand the unique ways the pandemic impacts employment, housing, public resources, ICE activity and immigration courts.

Read on to learn more about the need for our services and our impact over the past year.

Meeting Exacerbated Needs

Days after the first cases were reported, we shifted to remote operations, equipping staff to continue our work as the need for help grew exponentially.

For our neighbors living on economic and health margins, the pandemic has further exacerbated their instability in extreme ways.

The need for our services before the pandemic:

- More than two thirds of low-income households were experiencing at least one civil legal problem that significantly impacted daily life. These rates are much higher for survivors of domestic violence, immigrants, veterans, families, and parents of children with disabilities.

- In Mecklenburg County, poverty, segregation, and income inequality have pushed residents to the sidelines, concentrating distress in family stability and fortifying barriers to economic opportunity.

- Children born into poor families in Mecklenburg County are among the least likely in the U.S. to escape poverty.

- About 300,000 Mecklenburg residents were eligible for our services.

Public agencies closed and delayed services just as newly unemployed individuals found themselves trying to piece together a semblance of stability navigating administrative and public benefits systems for the first time.

Those already depending on these systems (people with disabilities, children, seniors, veterans and their families) were desperate to prevent the illness, hunger and homelessness that could result from losing Medicaid, Food Stamps, Social Security, Supplemental Security Income (SSI) or other benefits.

The combined effects of racial, gender, ethnic, and other forms of bias create multiple barriers for people of color and women as they navigate institutions where entrenched disparities remain the status quo.

This clear intersectionality has yielded disproportionately negative impacts for people of color and women during the pandemic. Because of this reality, we have continued to identify and address systemic racism while fighting to ensure equal access to assistance.

When Mecklenburg County’s Department of Social Services (DSS) closed its offices to the public on March 18 with little notice, we fought to make sure our neighbors could still get benefits and services guaranteed to them under the law.

We made DSS agree to:

- honor the date of phone calls as date of application for applicants to ensure they receive the maximum amounts of benefits allowed;

- not terminate benefits for missed deadlines; and

- allow late appeals, and to post clear signage in front of their buildings outlining this information.

The closure sent applicants to the agency’s call center which meant longer wait times for help.

We made sure people understood their eligibility for public benefits, helped them apply and navigate confusing administrative systems, all while ensuring their rights were protected. When programs and services changed, we kept the community informed.

We continue to advocate for extensions and flexibilities that are favorable to beneficiaries, while serving as a watchdog to ensure those policies are appropriately enforced and accessible to applicants of all backgrounds.

‘Things are smoother now.’

Food Insecurity

Before the pandemic, about 12 percent of Mecklenburg residents, including children, were considered food insecure according to Feeding America. The ongoing economic fallout has swollen that number to almost 16 percent who are on the brink of hunger.

In the last year, our staff assisted 371 people and their families with issues accessing food stamps (SNAP benefits), making sure they could successfully get the assistance they needed to remain stable and understood their eligibility for SNAP and other public benefits.

North Carolina was among the earliest adopters of Pandemic EBT (PEBT), which provides food support for families with children eligible for free or reduced-price meals while schools were closed. Though N.C. took many positive steps in creating this program, there have been hurdles and confusion in the implementation. We have been working closely with clients, partner organizations, and the state to monitor issues on the ground and communicate them to N.C. Department of Health and Human Services to ensure the program works efficiently and families receive these critical benefits quickly.

Healthcare Access

Before the pandemic, one in six Americans had a civil legal problem that negatively impacted their health. We knew that unmet legal needs related to COVID-19 would dramatically worsen health outcomes.

Thirteen percent of Mecklenburg residents don’t have health coverage. More than 500,000 low-income people in N.C. have no options to get health care because they earn too much to qualify for Medicaid and too little to receive financial assistance for health insurance.

COVID-19 forced frontline workers to weigh the risks of working to keep their families stable with the chance of falling critically ill and needing to seek medical care they couldn’t afford. Others lost health insurance benefits with their jobs at a time when access to health care mattered most.

Many who lost their jobs due to COVID-19 did not realize they had the option to apply for health care coverage through a Healthcare Insurance Marketplace Special Enrollment Period (SEP) 60 days after losing coverage. Consequently, many went without it due to their inability to afford private insurance.

Johanna Parra, coordinator of the Advocacy Center’s Health Insurance Navigator Project, was among the first in the nation to discover another option for those who were desperate to get coverage and have peace of mind knowing they could get care if they needed it.

Because all 50 states were under the COVID-19 pandemic national emergency declaration, eligible individuals could apply for coverage through the Affordable Care Act’s Health Insurance Marketplace, also referred to as “Obamacare,” for a Special Enrollment Period through the Federal Emergency Management Agency (FEMA SEP).

Fighting for Equal Access

As soon as Congress passed the CARES Act to provide economic support and COVID-19 relief, there was confusion around the benefits included in the package.

Understanding the CARES Act and COVID Relief: Stimulus Payments and Unemployment Benefits

Families desperate for financial support needed help making sure they received stimulus checks (Economic Impact Payments) issued by the federal government.

Who was eligible? How would payments be distributed? What if payments didn’t arrive?

We answered these questions and more for our clients and the community to ensure everyone eligible for a payment could receive it.

Staff are now helping people address missing stimulus checks and other issues related to the CARES Act as people try to prepare their 2020 tax returns at a time when collection activities and massive job losses strain taxpayers. We are working to resolve these issues and push the IRS to offer specific remedies for various issues related to stimulus checks.

We are also working closely with clients and partner organizations to ensure the latest COVID-19 stimulus opportunities from the American Rescue Plan are understood and correctly received.

We partnered with WCNC Charlotte to produce a resource page to answer questions about stimulus payments and unemployment insurance.

By May of last year, more than one million North Carolinians had applied for unemployment insurance benefits. The volume of applications paired with implementing new assistance programs under the federal CARES Act has caused significant delays, making the process more challenging for applicants.

Working together, Charlotte Center for Legal Advocacy and Legal Aid of North Carolina-Charlotte answered the calls of thousands of frustrated workers to guide them through the application process and appeals. Through direct action and systemic advocacy, these organizations ensured that those who had fallen through the cracks had access to the full payments they deserved.

Prior to the pandemic and historically, North Carolina’s unemployment system made it difficult for eligible residents to receive unemployment benefits, leaving workers with little to no support.

Charlotte Center for Legal Advocacy is focused on removing some of these barriers by focusing on unemployment insurance system reform, essential worker benefits, living wages, and promoting workers’ rights in a right to work state—all of which disproportionately impact People of Color (POC).

We are also monitoring how scams and multi-level marketing schemes (MLMs) target unemployed and low-income individuals, especially during the COVID-19 crisis.

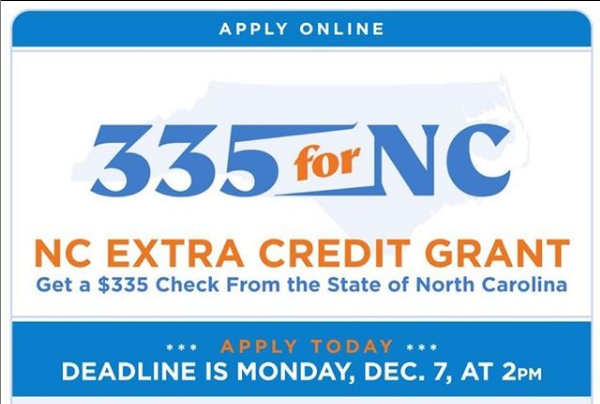

NC Extra Credit Grant

The NC Extra Credit Grant program provides financial support for families struggling to meet the demands of educating and caring for their children during the COVID-19 pandemic. For a parent living on minimum wage, $335 is more than he or she will earn in a week. We worked to spread the word to make sure that families who missed the first deadline didn’t miss this final application period and the chance at financial assistance.

Quick action and a strong partnership generated 24,946 applications submitted; $8 million distributed, in just 18 days.

On September 4, Gov. Roy Cooper announced the Extra Credit Grant: an additional $335 dollars in COVID-19 relief for N.C parents. While middle and high-income families automatically received the payment, low-income families had to apply through the North Carolina Department of Revenue (NCDOR).

These families had just 29 days to learn about the program and apply. Only 10,000 families did so during the initial application period.

Through a pro bono partnership, Legal Aid of North Carolina, Charlotte Center for Legal Advocacy, and Robinson Bradshaw filed a complaint resulting in a court order on Nov.5, 2020 that reopened and extended the application period.

Charlotte Center for Legal Advocacy created a website and extensive communication campaign entitled 335 for NC, which encouraged these parents to apply for the grant through December 7, 2020. More than 32,000 individuals visited the website.

In just 18 days, Charlotte Center for Legal Advocacy, Legal Aid of North Carolina, and Robinson Bradshaw reached hundreds of thousands of families and delivered 24,946 applications to NCDOR resulting in more than $8 million in aid made available to families who needed it most.

Keeping Families Safe and Protected from Exploitation

Housing Rights

State and federal moratoriums on evictions and foreclosures have been implemented and continued over the past year to keep people who couldn’t pay their bills safely housed during the pandemic, but they haven’t been enough to protect everyone.

As we watched infection rates rise, courts in North Carolina started working through backlogged foreclosures. Evictions began ramping up, exacerbating the shortage of affordable housing that existed well before the threat of coronavirus. Homeowners who had to take advantage of forbearance because they could not pay their mortgages will eventually have to repay extraordinary balances on their home loans, many of which cannot be modified.

The Advocacy Center continues to work with families desperate to keep their homes and stay current on their bills to avoid homelessness and financial ruin. We are making sure people understand their rights and obligations with lenders to help them make informed decisions about their situations. We are also educating the community to make sure our neighbors do not fall victim to scams related to COVID-19.

‘The weight that was lifted off’

Entrepreneur, grandmother, personal shopper, caregiver, and church activist. These are a few of the hats that Mrs. C wears on any given week. She keeps copious amounts of to-do lists to keep herself, her family, and her business in order, a skill she says she learned from the staff at Charlotte Center for Legal Advocacy.

Immigrant families were already targets for exploitation before the pandemic. Fear of deportation, language barriers, and lack of traditional financial resources make it harder for immigrants to get assistance and leave them vulnerable.

Owners of substandard housing often rent to immigrants because the owners believe those tenants will be afraid to exercise their rights to habitable housing and to continued tenancy.

Traditional financing options are also often unavailable to immigrant families, which makes them easy targets for predatory financing options such as contracts for deed, options to purchase, installment sales contracts or lease with option contracts. These are enforced through eviction procedures and are complicated to defend without legal assistance.

Immigrants are also targeted for predatory sales of mobile homes, which can be substandard. These situations often involve predatory financing methods on land that is rented and are subject to eviction from the land, also requiring complicated defense.

The pandemic hit immigrants especially hard. Primary earners lost jobs as businesses shut down and those without legal status didn’t qualify for COVID-19 assistance.

“Because of the virus we lost our jobs and that put us behind on rent. And now it’s worse because my husband had an accident and our court date is tomorrow so we don’t know what we’re going to do … We don’t get help from anyone, those of us who are undocumented. A lot of us are going through this.”

– Advocacy Center client Ismar spoke to WFAE as her family faced eviction in July. Attorney Juan Hernandez was able to negotiate an agreement with the family’s landlord to prevent them from losing their home. Listen to the full story.

Thinking they could take advantage of families in desperate situations, landlords continued to threaten and illegally remove families from their homes.

At a time when our court system was operating on a limited capacity and resources for assistance were scarce, we helped our clients avoid homelessness, remain stable and exercise their rights.

We upheld their rights through our work, which included remedies such as cancellation of the contract, recovery of down payment or money paid above and beyond the fair market rental value, damages for unfair and deceptive trade practices, among others. We also conducted community education programs regarding the rights of immigrant renters related to their housing.

Domestic Violence Protection

While officials urged people to stay home to prevent spreading the virus, home wasn’t the safest option for many in our community.

Immigrant women also face additional barriers to escaping domestic violence or abuse, leaving them feeling trapped in abusive situations.

Charlotte Center for Legal Advocacy helps low-income immigrants living in Mecklenburg County who are victims of domestic violence. A recent Allstate Foundation national survey found that 64 percent of Hispanic women say they know a victim of some type of abuse and 30 percent have personally been victimized.

Reports of domestic violence incidents increased significantly along with the need for legal assistance to get necessary protection early in the pandemic as people. Advocacy Center staff helped survivors and their families navigate administrative changes to get the protections they needed while our courts were closed.

Our Response Continues

We are all weathering the same storm, but we are not all in the same boat.

The past year has made it clear just how critical access to safety, security and stability is for everyone in our community.

But barriers that prevent equal access to these needs persist. And our current safety net is simply not wide or strong enough to support everyone who needs it.

Much like the Great Recession of 2008, the recovery for those hit hardest by COVID-19, those we serve, will take years. Some will never recover.

The need is everywhere. That’s why we’re here, fighting to help families not only stay afloat but also thrive. And we’re not going anywhere.

Today and every day, we continue this hard, necessary work until our community is a stronger, more just and equitable place for ALL.

Find the latest COVID-19 Updates

Learn about our 2021 Advocacy Agenda

Support Our Work

CDC Eviction Moratorium: What you Need to Know

*Updated June 29, 2021. Original post September 10th, 2020*

The federal government, through the Center for Disease Control, has announced a temporary halt on evictions through July 31, 2021 to prevent the further spread of COVID-19. Under the order, landlords and property owners are prohibited from evicting certain tenants impacted by COVID-19. If you are an immigrant, you may have concerns about claiming protection under the eviction moratorium. While we think the risk is minimal, we provide the information below to help you decide what is best for you and your family.

How do I Qualify?

You qualify for the temporary protection against eviction if one of the following applies in your situation:

- You cannot pay your full rent payment because of household income, loss of compensable hours of work or wages, lay-offs, or extraordinary out-of-pocket medical expenses.

- Your income is below $99,000 annually for an individual/ $198,000 annually for a couple.

- You are using your best efforts to make timely partial payments that are as close to the full payment as your circumstances permit.

- You have used best efforts to obtain all available government assistance available for rent or housing.

- If evicted, you will become homeless or will have to move in with others in close quarters.

How do I claim protection under the Temporary Eviction Moratorium?

To claim the protection against eviction, every adult tenant must sign an affidavit that includes an agreement to pay any accumulated rent arrears after July 31, 2020.

- Sign this declaration if the tenant meets its requirements.

- The declaration is a sworn statement, and there are criminal penalties for signing the declaration if it is not true!

- Give the signed declaration to the landlord

- Keep copies of the signed declaration.

- Follow the rental agreement.

Why might I worry about signing the affidavit as an immigrant?

An immigrant may be denied a visa, lawful permanent resident status, or reentry into the US (as a lawful permanent resident) if she or he is likely to become a public charge. Public charge is defined as someone who is primarily dependent on the government for subsistence.

Why I SHOULD NOT worry about signing the affidavit even though I am an immigrant:

- Getting help under the Temporary Eviction Moratorium is not considered cash or other financial assistance that could count against you as a federal benefit for the public charge test.

- The income limit for the federal moratorium is substantially higher than the income threshold for the public charge test. When you state that your income is not above $99,000/$198,000 annually, you do not admit that your income is below 125% federal poverty guideline ($32,750 annual income for family of 4) and, therefore, you do not jeopardize your immigration application.

Is it conceivable that my immigration application could be denied because I signed the affidavit stating that I cannot afford my rent?

It is conceivable but very unlikely and, certainly, there should be a legal challenge to a finding of public charge on this basis.

Remember that public charge DOES NOT APPLY to:

- Asylum or Refugee status

- Green Card renewal

- TPS, U or T Visa status

- DACA status or renewal

- Special Immigrant Juvenile Status

- Violence Against Women Act (VAWA)

- Immigrants who already have LPR/ a green card

CONTACT CHARLOTTE CENTER FOR LEGAL ADVOCACY TO SPEAK TO SOMEONE ABOUT YOUR OPTIONS.

- 704-376-1600

- Línea en español 800-247-1931

Obtenga La Ayuda Que Necesita Bajo La Moratoria Temporal De Desalojo

El gobierno federal, a través del Centro para el Control de Enfermedades, ha anunciado una suspensión temporal de TODOS los desalojos hasta el 31 de julio de 2021 para evitar una mayor propagación de COVID-19. Según la orden, los propietarios tienen prohibido desalojar a ciertos inquilinos afectados por COVID-19. Si usted es un inmigrante, es posible que le preocupe reclamar protección bajo la moratoria de desalojo. Mientras creemos que el riesgo es mínimo, la siguiente información puede ayudarle a decidir qué es lo mejor para usted y su familia.

¿Cómo califico para la moratoria?

Usted califica para la protección temporal contra el desalojo si alguna de las siguientes situaciones le aplica:

- No puede pagar el pago total del alquiler debido a los ingresos del hogar, la pérdida de horas de trabajo o salarios compensables, despidos o gastos médicos extraordinarios de su bolsillo.

- Sus ingresos son menos de $99,000 anuales por persona o $198,000 por pareja.

- Está haciendo todo lo posible para realizar pagos parciales puntuales que se acerquen tanto al pago total como lo permitan sus circunstancias.

- Ha hecho todo lo posible para obtener toda la asistencia gubernamental disponible para alquiler o vivienda.

- Si lo desalojan, se quedará sin hogar o tendrá que mudarse con otras personas cercanas.

¿Cómo reclamo protección bajo la Moratoria Temporal de Desalojo?

Para reclamar la protección contra el desalojo, todos los inquilinos adultos deben firmar una declaración que incluye su acuerdo de pagar los atrasos de alquiler acumulados después del 31 de julio de 2020.

¿Por qué podría preocuparme firmar una declaración como inmigrante?

A un inmigrante se le puede negar una visa, el estatus de residente permanente legal o el reingreso a los EE. UU. (como un residente permanente) si es probable que se convierta en una carga pública. La carga pública se define como alguien que depende principalmente del gobierno para su subsistencia.

Porque no DEBO preocuparme por firmar la declaración a pesar de que soy un inmigrante?

- Obtener ayuda bajo la Moratoria de Desalojo Temporal no es considerado dinero en efectivo u otra asistencia financiera que pueda contarse en su contra como un beneficio federal para la prueba de carga pública.

- El límite de ingresos para la moratoria federal es sustancialmente más alto que el límite de ingresos para la prueba de carga pública. Cuando declara que sus ingresos no superan los $ 99,000 / $ 198,000 anuales, no admite que sus ingresos estén por debajo del 125% de la línea de pobreza federal (Ingresos anuales de $ 32,750 para una familia de 4) y, por lo tanto, no pone en peligro su solicitud de inmigración

¿Es concebible que mi solicitud de inmigración pueda ser negada por firmar una declaración declarando que no puedo pagar el alquiler?

Es concebible pero muy improbable y definitivamentedebería haber una impugnación i legal contra una determinación de carga pública basado en esto.

Recuerde que la carga pública NO APLICA a:

- Asilados o refugiados

- Renovación de su permiso de residencia

- TPS, Visa U o Visa T

- Estado de DACA o renovación de DACA

- Estado Especial de Inmigrante Juvenil

- Ley de Violencia Contra la Mujer (VAWA)

- Inmigrantes que ya tienen Residencia Permanente

Comuníquese con Charlotte Center for Legal Advocacy para hablar con alguien sobre sus opciones.

- Línea en español 800-247-1931

- charlottelegaladvocacy.org

Unemployed or working fewer hours during COVID-19? 5 things to consider

Many people are trying to figure out what their options are after losing their jobs or having work hours reduced during COVID-19. Charlotte Center for Legal Advocacy is here to help. Contact us if you need assistance figuring out your options. Here are 5 ways we can help you and your family remain stable:

1. Unemployment Benefits:

- You should apply for unemployment benefits right away. You can apply online at des.nc.gov or by calling 1-888-737-0259. If you cannot get through, keep trying and document your attempts.

- Remember to fill out the weekly certifications online at des.nc.gov or by calling 1-888-372-3453 every week, even if your application has not been approved yet or you have been disqualified for benefits and have filed an appeal.

- If you are self-employed, haven’t worked recently, or you are applying for or receiving disability benefits you may be eligible for unemployment benefits if you are out of work or unable to work due to COVID-19. This includes parents who must stay home because their children are out of school.

- During this emergency, the amount of unemployment benefits has been increased by $600 per week through July 31, 2020. You can also receive the benefits for more weeks.

- Immigrants with work authorization may be eligible for unemployment benefits. Unfortunately, undocumented immigrants are not eligible.

2. Stimulus Payments:

- Most people should get a stimulus payment from the IRS of $1,200 for each adult and $500 for each child under age 17. You can get this payment even if you are not required to file a tax return.

- You must be authorized to work in the U.S. to be eligible for these payments, typically this means you have a SSN that’s valid for employment. Unfortunately, this means many immigrants may not be eligible for a stimulus payment.

- If you have not received your payment, call Charlotte Center for Legal Advocacy’s Taxpayer Clinic hotline at 980-202-7329.

3. Evictions, Foreclosures, Utility Cut-Offs and Student Loan payments

- You cannot be evicted by your landlord or have your house foreclosed until after a court hearing. Those court hearings are on hold at least until June 2020.

- If you have a federally backed mortgage loan such as Fannie Mae, Freddie Mac, VA, USDA, FHA or Home Equity Conversion mortgage (“Reverse mortgage”), you may be entitled to two 180-day forbearances on your mortgage payments without late fees being added.

- Utilities, including electric, gas, and water services are prohibited from disconnection for customers unable to pay during the COVID-19 pandemic and from collecting fees, penalties, or interest for late payments until June. Residential customers have at least six months to pay outstanding bills.

- Certain student loans may be entitled to have their payments suspended through September 2020.

- Charlotte Center for Legal Advocacy or Legal Aid may be able to help you prevent eviction, foreclosure, or utility cut-off. Call us at 704-376-1600.

4. Health Care Coverage:

- You and your children may now be eligible for Medicaid.

- If you cannot get Medicaid, you may be able to enroll in Obamacare/Marketplace coverage with financial assistance if you recently lost your health coverage or had a change in circumstances. You have 60 days after losing your coverage or the change to enroll.

- If you are already enrolled in Obamacare/Marketplace and cannot pay your premiums, you may qualify for lower premiums.

- Charlotte Center for Legal Advocacy’s Health Insurance Navigator Project can help you find the best and most affordable coverage options for you and your family. We can help you complete an application, update your Obamacare/Marketplace coverage, or answer general health insurance questions. We can also help if you get denied for coverage or services. Call 980-256-3782 to schedule a free, over the phone appointment today!

5. Food Assistance:

- You may be eligible for food stamps. The amount of food stamp benefits has been increased and time limits/work requirements for some people have been waived during the coronavirus pandemic.

- Charlotte Center for Legal Advocacy can help you apply for food stamps over the phone. We can also help if you get denied. Our help is free. Call us at 980-256-3782.

- Even families not eligible for food stamps will receive an EBT card in the mail to use to buy food if their children qualify for free and reduced lunch at school. Your immigration status does not matter. If you do not get this card, call us at 704-376-1600.

- Families with no income can also get cash assistance for their children from Social Services under the Work First program. The amount of Work First benefits have been increased and work requirements waived during the pandemic.

Apply by phone by calling Social Services at 704-336-3000. If you get denied or cannot apply, call us at 704 376-1600.