Third COVID-19 Relief Package Passes as Pandemic Marks One Year

On March 11, 2021, President Biden signed the American Rescue Plan into law as the largest and most recent COVID-19 relief package extending $1.9 trillion dollars in aid to families, businesses, nonprofits, and states. This third round of aid comes as Charlotte Center for Legal Advocacy marks a full year fighting to support families under the pandemic.

And our work is far from done.

As we learn more about how the plan’s programs and funding will be implemented, we will update our website and social media accordingly. Please contact us at the appropriate numbers below if you or your family are struggling and need assistance.

This list is not exhaustive, and the bill contains programs and funding not listed here.

Here is what we know so far:

ECONOMIC IMPACT PAYMENTS (STIMULUS CHECKS) AND TAX CREDITS

The American Rescue Plan includes a third round of tax-free economic stimulus payments.

In this version, the maximum payment is $1,400 per qualified individual or $2,800 for a couple. In addition, payments are now available for all dependents, including children in college and elderly relatives. Children of mixed-immigration status families with valid social security numbers are also eligible for the stimulus payments

The additional amount for dependents is significantly higher – $1,400 per eligible dependent.

As before, economic stimulus payments are phased out, based on adjusted gross income. However, the upper threshold is reduced from $100,000 of adjusted gross income to $80,000 for single filers and from $200,000 down to $160,000 for joint filers. Payments for dependents are also phased out under these thresholds.

The IRS expects to begin sending out payments in March.

Third Economic Stimulus Payments Will Be Based on 2019 or 2020 Tax Returns:

The American Rescue Plan provides that if your 2020 tax return is not filed and processed by the time the IRS starts processing your third stimulus payment, the tax agency will use information from your 2019 tax return. If your 2020 return is already filed and processed when the IRS is ready to send your payment, then your stimulus check eligibility and amount will be based on information from your 2020 return.

If your 2020 return is filed and/or processed after the IRS sends you a stimulus check, but before July 15, 2021 (or September 1 if the April 15 filing deadline is pushed back), the IRS will send you a second payment for the difference between what your payment should have been if based on your 2020 return and the payment sent based on your 2019 return.

If you have questions about the economic impact payments, contact a tax advocate at 980-202-7329

Child Support Won’t Be Taken Out of Stimulus Checks:

As with second-round checks, third stimulus checks will not be reduced to pay child support arrears.

Wage Garnishment:

The COVID-Related Tax Relief Act prevented garnishment of second-round stimulus checks by creditors or debt collectors. They could not be lost in bankruptcy proceedings, either. The IRS also had to encode direct deposit second-round payments so that banks knew they could not be garnished. This is in contrast with the CARES Act, which did not provide similar protections for first-round payments. These protections are included for the third stimulus payment as well.

Under the American Rescue Plan, payments will be protected from reduction or offset to pay federal taxes, state income taxes, debts owed to federal agencies, and unemployment compensation debts. (As well as child support, as was discussed above.) However, as with first-round checks under the CARES Act, there will be no additional protections against garnishment by private creditors or debt collectors for third-round payments.

Earned Income Credit

The American Rescue Plan expands the Earned Income Tax Credit for 2021, raising the maximum credit for childless adults from roughly $530 to close to $1,500, while also increasing the income limit for the credit from about $16,000 to about $21,000, and expanding the age range that is eligible by eliminating the age cap for older workers.

Child Tax Credit

The American Rescue Plan includes changes to the Child Tax Credit (CTC). Under current law, the CTC is equal to $2,000 for each qualified child under age 17 who resides with you for at least six months of the year. Up to $1,400 of this amount is refundable, but the credit begins to phase out at $200,000 of adjusted gross income for single filers and $400,000 for joint filers.

This credit will not go into effect until the 2021 tax year, which will be filed in Spring 2022.

The new law provides the following revisions for the 2021 tax year:

- An increase in the CTC to $3,600 per qualified child under age six and $3,000 for a child up to age 17.

- An additional $500 credit is available for dependent children in college who are under age 24.

- The credit is fully refundable.

- The phaseout begins at lower levels of $75,000 of adjusted gross income for single filers and $150,000 for joint filers. But many higher-income families can still claim the $2,000 credit subject to the prior phaseout rules.

Finally, the IRS will make advance payments of the credit, beginning in July. The exact logistics of that process are still being worked out.

Dependent Care Credits

The American Rescue Plan substantially increases the Dependent Care Credit for many moderate-to-high income taxpayers.

Presently, the Dependent Care Credit is available for qualified expenses of caring for children under age 13 to allow you (and your spouse, if married) to be gainfully employed. The credit is generally equal to 20 percent of the first $3,000 of qualified expenses for one child and $6,000 for two or more children. Thus, the maximum credits are $600 and $1,200, respectively.

The new law enhances the Dependent Care Credit for the 2021 tax year.

It increases the maximum credit to $4,000 for one child and $8,000 for two or more children for households with an adjusted gross income of up to $125,000. But the credit will be reduced below 20% for those with an adjusted gross income of more than $400,000. Finally, the credit for 2021 is refundable.

This credit will not go into effect until the 2021 tax year, which will be filed in Spring 2022.

Student Loan Forgiveness Credit

If a debt is forgiven or cancelled, it generally results in taxable income to the debtor. However, in limited cases, debts of student loans that are forgiven may be exempt from tax.

The American Rescue Plan effectively creates a tax exemption for student loans made, insured or guaranteed by the federal or state governments, as well as loans from private lenders and educational institutions. This does not apply, however, to loans that are discharged in exchange for services rendered.

This provision is effective beginning with the 2021 tax year and lasts through the 2025 tax year but could be extended or made permanent.

Taxes on Unemployment Benefits

The American Rescue Plan exempts from federal income tax up to $10,200 of unemployment benefits received in 2020 by a family with an adjusted gross income under $150,000. Normally, those benefits would be fully taxable. This tax break is intended to help taxpayers who might be blindsided by an unexpected tax bill on their 2020 returns.

Please note that states can still tax unemployment benefits as income.

UNEMPLOYMENT INSURANCE

The American Rescue Plan extends the CARES Act’s unemployment insurance expansion through Sept. 6, 2021. Specifically, this act:

Provides an additional $300 per week to on top of what beneficiaries are getting through their state unemployment insurance program.

The first $10,200 of jobless benefits accrued in 2020 would be non-taxable for households with incomes under $150,000. Please note that states can still tax unemployment benefits as income.

Extends the Pandemic Unemployment Assistance (PUA) program, which provides continued unemployment assistance to the self-employed, freelancers, gig workers, part-time workers and other individuals in non-traditional employment. It also increases the number of weeks of PUA benefits an individual may claim, from 50 to 79;

Extends the Pandemic Emergency Unemployment Compensation (PEUC) program, providing additional weeks of federally-funded benefits to workers who have exhausted their regular state unemployment benefits. It also increases the weeks of PEUC benefits an individual may claim, from 24 to 53.

Apply for unemployment at the Department of Employment Security website or call 1-888-737-0259.

EMERGENCY MORTGAGE, RENTAL AND UTILITY SERVICES

The plan provides $25 billion for emergency rental assistance, including $5 billion for emergency housing vouchers for people experiencing homelessness, survivors of domestic violence and victims of human trafficking.

The plan also sends roughly $20 billion to state and local governments to help low-income households cover back rent, rent assistance and utility bills. There is $4.5 billion for the Low-Income Home Energy Assistance Program (LIHEAP) to help families with home heating and cooling costs.

You can apply for utility assistance through the Low-Income Home Energy Assistance Program or RAMP Charlotte.

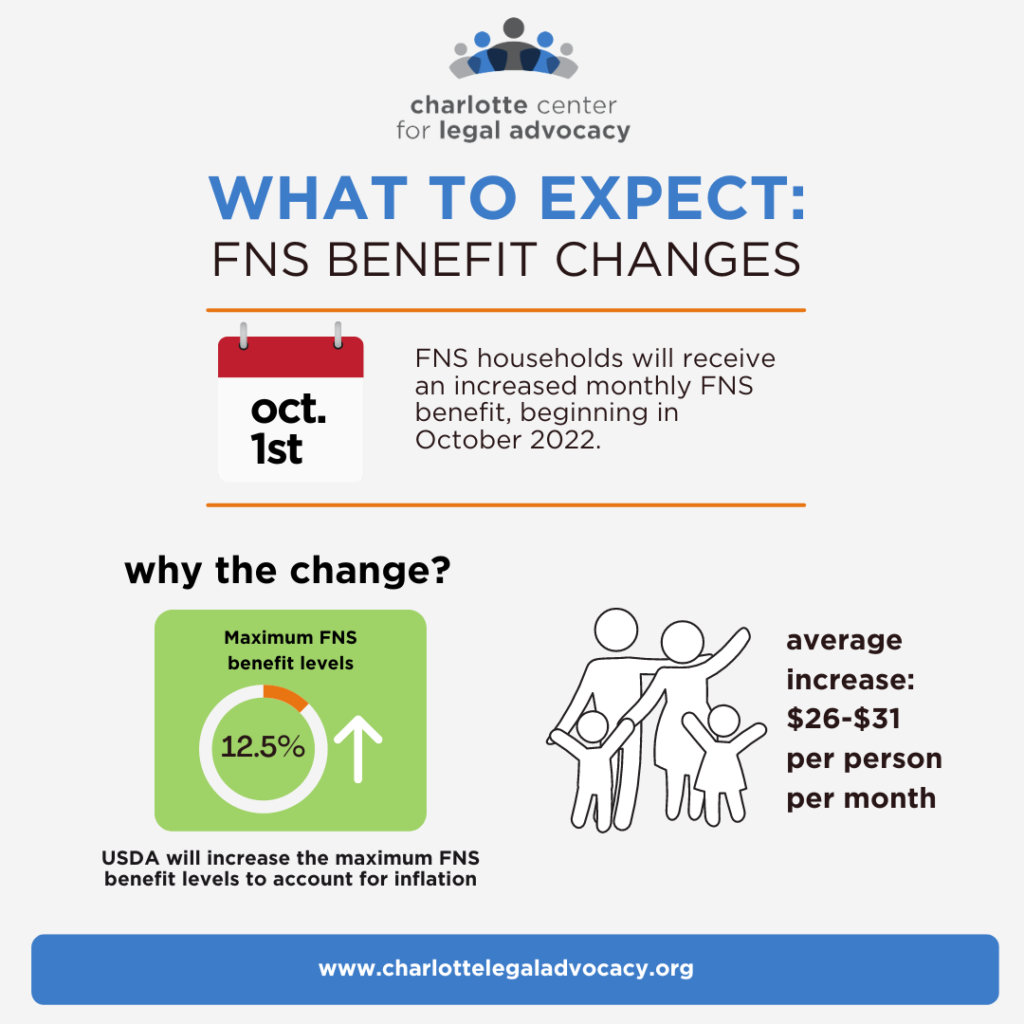

FOOD AND NUTRITIONAL ASSISTANCE

Millions of families across the country are struggling to put food on the table. This act addresses food insecurity by:

- Extending the current 15 percent increase in food stamp benefits through September 2021, instead of letting it expire at the end of June.

- Providing $880 million for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) to help increase participation and temporarily improve benefits

- Allowing states to continue the Pandemic-EBT (PEBT) program through summer for families with children who qualify for free and reduced meals in school. The program gives families financial assistance to replace the meals the kids would have received if schools had not been closed due to COVID-19.

If you need assistance with applying for SNAP, PEBT, or other public benefits, contact our Family Support and Healthcare team at 704-376-1600.

CHILD CARE

The plan includes a number of provisions to increase access to child care, including an additional $15 billion through Sept. 30, 2021 for the Child Care and Development Block Grant.

It does not reinstate mandatory paid family and sick leave approved in the CARES Act. But it will continue to provide tax credits to employers who voluntarily choose to offer the benefit through October 1, 2021.

STUDENT LOANS

Many federal student loans are continuing in forbearance, which is scheduled to end October 1. If student loan debt is forgiven after December 31, 2020, and before January 1, 2026, the cancelled debt won’t be taxed.

FINANCIAL ASSISTANCE FOR HEALTH INSURANCE

More Help to Pay for Health Coverage under the Affordable Care Act (ACA):

The American Rescue Plan provides financial assistance to help consumers get health insurance through the Federal Health Insurance Marketplace under the Affordable Care Act (ACA or Obamacare).

Under the plan, consumers can receive increased premium tax credits to pay for coverage in 2021 and 2022, eliminating or reducing premiums for millions of current Marketplace enrollees to ensure that no one on the exchange spends more than 8.5 percent of their income on coverage premiums, regardless of their income level.

This reduces the current 9.83 percent limit for people with income of 300 to 400 percent of the poverty line and establishes a new premium cap for Marketplace enrollees with higher incomes.

Under the bill, people with income below 150 percent of the poverty line (about $19,000 for a single person and $39,000 for a family of four) would pay no premiums for a benchmark plan, after accounting for premium tax credits. Families who make more will pay a fixed percentage of income toward Marketplace health coverage.

This will significantly reduce premiums for people who are currently eligible for financial help by increasing their premium tax credits. For example:

- A single individual making $18,000 would pay zero net premium rather than $54 per month (3.6 percent of income) and would qualify for the most generous subsidies for deductibles and other cost-sharing amounts.

- A single individual making $30,000 would pay $85 rather than $195 per month in premiums (3.4 instead of 7.8 percent of income) and would qualify for a plan with reduced deductibles and other cost-sharing amounts. Or, with the bigger subsidy, the same person could opt to buy a gold plan with lower cost-sharing charges for $115 per month.

- A family of four making $50,000 would pay $67 rather than $252 per month in premiums for benchmark coverage (1.6 instead of 6.0 percent of their income) and would qualify for generous cost-sharing reductions.

- A family of four making $75,000 would pay $340 rather than $588 per month in premiums for benchmark coverage (5.4 instead of 9.4 percent of their income). A typical family could purchase a gold plan with lower deductibles and other cost sharing for about $440 per month (roughly 7 percent of income).

An open enrollment period will begin November 1 for anyone who wants to sign up for health insurance or change their current Marketplace plan.

Streamlines process to qualify for ACA subsidies

The package also enhances premium tax credits (financial assistance) for people who receive unemployment benefits in 2021 by setting their Marketplace eligibility at a projected income levels that guarantee they will get the most generous premium tax credits under an ACA Marketplace plan, regardless of what their actual year-end income ultimately is. This includes people who have previously found themselves in the Medicaid gap.

The package also eliminates the need to repay ACA subsidies from 2020. Some people lost their jobs early last year but later got new ones and saw higher earnings than they had expected. Others worked additional hours or received bonus pay as essential workers. Under this plan, low- and moderate-income families are exempt from having to repay the premium tax credit (financial assistance) they received in 2020.

COBRA premiums covered

Under the relief plan, the government would pay the entire COBRA premium from April 1 through Sept. 30, 2021 for those who lost employer-based coverage due to lay-offs or working reduced hours.

A person who qualifies for new, employer-based health insurance someplace else before Sept. 30 would lose eligibility for the no-cost COBRA coverage. Someone who leaves a job voluntarily would not be eligible either.

Incentivizes States to Expand Medicaid Eligibility

The plan incentivizes states that still have not expanded their Medicaid programs (like North Carolina) to expand eligibility for adults by increasing matching federal funds (raising the state’s Federal Medical Assistance Percentage by 5 percentage points) over two years.

In North Carolina, this means more than 500,000 residents in the Medicaid gap (those who currently make too little to receive financial help for Marketplace coverage and make too much to qualify for Medicaid) would finally have access to coverage and the health care at a time when they need it most.

This incentive would pump $2.4 billion new federal dollars into the state in just two years if N.C. is willing to take advantage of it.

States choosing to expand would be required to maintain Medicaid coverage levels to receive the increase, including the newly established requirement to cover COVID-19 vaccine and treatment (see below).

Covers COVID Testing and Treatment

The plan also requires Medicaid and Childrens Health Insurance Program (CHIP) coverage of COVID-19 vaccines and treatment without beneficiary cost sharing. Vaccines and vaccine administration costs would be matched at 100 percent until one year after the end of the Pandemic Health Emergency. States also would have the option to provide coverage to the uninsured for COVID-19 vaccines and treatment without cost sharing at 100 percent. Everyone should have access to COVID testing, treatment, and vaccinations regardless of income, insurance, or immigration status.

Expands Access to Postpartum and Child Health Care

The plan also gives states five years to extend their Medicaid and Children’s Health Insurance Program (CHIP) eligibility to include pregnant individuals for 12 months postpartum. States choosing this option must provide the full Medicaid benefit for pregnant and postpartum individuals during the 12-month postpartum period.

Increased Funds for Home and Community-Based Services

The plan provides temporary one-year FMAP increase to improve home-and-community-based-services as well as FMAP increases for services provided through the Urban Indian Organizations and Native Hawaiian Health Care Systems. The bill also would provide funding to states for the creation of nursing home strike teams to assist in managing COVID-19 outbreaks when they occur.

Option to create new Medicaid Program for Crisis Intervention Services

The plan gives states five years to creates a new optional Medicaid covered service for adults by offering mobile crisis intervention services for adults experiencing a mental health or substance use disorder crisis.

Have questions about how this plan impacts your coverage options or access to health care? Contact our Family Support and Health Care team by calling 704-376-1600