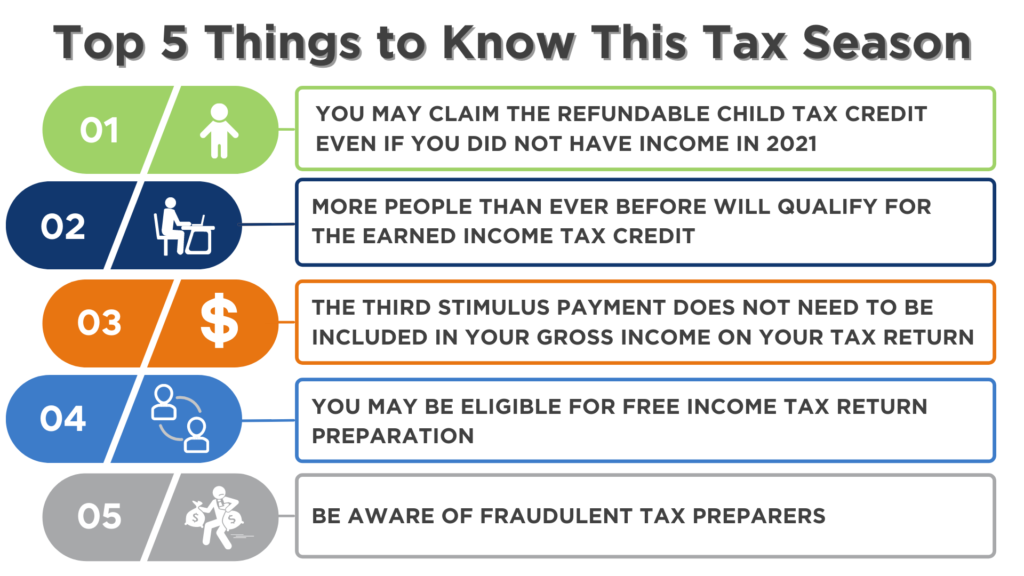

Tax filing season for 2021 Federal tax returns opened January 24, 2022 and will run through April 18, 2022. With the expansion of the Child Tax Credit and Earned Income Tax Credit last year, there may be more money available to you than you realize! Here is what we think you need to know, links to frequently asked questions, and where to find more help.

1. You may claim the Child Tax Credit even if you did not work or have income in 2021

You may claim the Refundable Child Tax Credit on your 2021 Federal income tax return even if you did not work or have any income. You must have lived in the United States for more than half of 2021 AND have a Qualifying Child with a valid Social Security Number.

If you aren’t required to file taxes this year, you can visit GetYourRefund.org to get your tax credit.

Want to know more about the Child Tax Credit? Visit our Child Tax Credit help page.

2. More people than ever before will qualify for the Earned Income Tax Credit

For the first time, workers 19-24 and 65 and older without kids at home now qualify for the tax credit, expanding eligibility to millions of additional workers nationwide. Additionally, if you did not qualify in the past because your income was too high, you may now qualify. Here’s what you need to know:

- You may qualify for a credit of more than $1,500 if you do not have children living with you.

- You may qualify for a credit up to $6,700 if you are raising children in your home.

- You may qualify if you make $27,380 or less without kids or $57,414 or less with kids.

Want to know if you qualify? Visit our Earned Income Tax Credit help page.

3. The third Economic Impact Payment (“Stimulus Payment”) does not need to be included in your gross income on your 2021 Federal income tax return

This means when you file your tax return:

- You will not owe any tax on the Stimulus Payment you received.

- It will not reduce your refund.

Note: The third Stimulus Payment will also not affect your income when determining your eligibility for federal government assistance or benefit programs.

If the information reported on your 2021 Federal income tax return would cause you to have qualified for a lesser third Stimulus Payment (compared to your 2020 or 2019 tax information which was used to calculate the payment you received), you will not be required to pay any of it back.

Missing your first, second, or third stimulus payments? Have more questions? Visit our stimulus payment help page.

4. You may be eligible for free income tax return preparation

If your household income in 2021 was $58,000 or less, you could qualify to have your taxes prepared and submitted through the IRS Volunteer Tax Assistance (VITA) program. Local VITA Tax services will primarily be provided virtually this year, but a limited number of in-person sites are also available.

National VITA Services:

English: GetYourRefund.org

En español: GetYourRefund.org en español

If your household income was $72,000 or less, IRS Free File also lets you prepare and file your FEDERAL income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. There are options available in English and Spanish: Free File: Do your Federal Taxes for Free | Internal Revenue Service (irs.gov)

5. Be aware of fraudulent tax preparers

The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

- DON’T use tax preparers who promise higher returns

- DO choose a tax preparer that has a valid IRS “Preparer Tax Identification Number” (PTIN).

- DON’T fall for flyers and advertisements promising you “free money” from the IRS. There is no such thing as “free money” from the IRS!

- DO review your return before you sign it and make sure your preparer signs it too.

Learn more about how to stay protected

6. BONUS TIP: We are here to help!

If you:

- have trouble with the IRS

- need assistance with an audit

- disagree with a tax bill the IRS has sent but they are still taking money from your paycheck

We are here to help!

Charlotte Center for Legal Advocacy’s North Carolina Low-Income Taxpayer Clinic serves all of North Carolina by offering tax controversy services to low-income taxpayers. The Tax Clinic serves taxpayers who earn less than 250% of the federal poverty standard, including people who speak English as a second language.

Contact us today: 980.202.7329

Resources

Filing your 2021 Federal Income Tax return: Child Tax Credit

Filing your 2021 Federal Income Tax return: Earned Income Tax Credit

Filing your 2021 Federal Income Tax return: Economic Impact Payment

Filing your 2021 Federal Income Tax return: Frauds & scams

Healthcare.gov Premium Tax Credits and Filing Your 2021 Taxes

Owe taxes but cannot pay?

IRS Payment Options