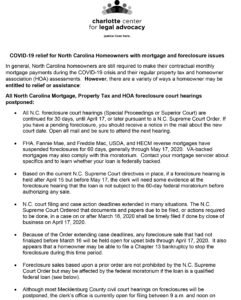

From Nicholas Holt, paralegal-advocate, and Leah Kane, senior attorney, of the Consumer Protection Program:

In general, North Carolina homeowners are still required to make their contractual monthly mortgage payments during the COVID-19 crisis and their regular property tax and homeowner association (HOA) assessments. However, there are a variety of ways a homeowner may be entitled to relief or assistance:

All North Carolina Mortgage, Property Tax and HOA foreclosure court hearings postponed:

- All N.C. foreclosure court hearings (Special Proceedings or Superior Court) are continued for 30 days, until April 17, or later pursuant to a N.C. Supreme Court Order. If you have a pending foreclosure, you should receive a notice in the mail about the new court date. Open all mail and be sure to attend the next hearing.

- FHA, Fannie Mae, and Freddie Mac, USDA, and HECM reverse mortgages have suspended foreclosures for 60 days, generally through May 17, 2020. VA-backed mortgages may also comply with this moratorium. Contact your mortgage servicer about specifics and to learn whether your loan is federally backed.

- Based on the current N.C. Supreme Court directives in place, if a foreclosure hearing is held after April 15 but before May 17, the clerk will need some evidence at the foreclosure hearing that the loan is not subject to the 60-day federal moratorium before authorizing any sale.

- N.C. court filing and case action deadlines extended in many situations. The N.C. Supreme Court Ordered that documents and papers due to be filed, or actions required to be done, in a case on or after March 16, 2020 shall be timely filed if done by close of business on April 17, 2020.

- Because of the Order extending case deadlines, any foreclosure sale that had not finalized before March 16 will be held open for upset bids through April 17, 2020. It also appears that a homeowner may be able to file a Chapter 13 bankruptcy to stop the foreclosure during this time period.

- Foreclosure sales based upon a prior order are not prohibited by the N.C. Supreme Court Order but may be affected by the federal moratorium if the loan is a qualified federal loan (see below).

- Although most Mecklenburg County civil court hearings on foreclosures will be postponed, the clerk’s office is currently open for filing between 9 a.m. and noon on weekdays. Please exercise caution and do not enter the courthouse if you are experiencing symptoms of illness.

Determine whether your mortgage is federally backed or a private loan to learn about specific relief:

- Most federally backed mortgages, which include FHA (HUD), HECM reverse mortgages, VA loans, Fannie Mae, Freddie Mac, FHFA, and USDA have suspended foreclosures and evictions of borrowers after foreclosure until May 17, 2020.

- If you are going to face hardship because of a job loss or otherwise during the COVID-19 crisis, contact your mortgage servicer about specific relief available, even if not federally backed.

Many private mortgage lenders will likely be offering assistance during this time. For both federal and private loans this may include:- Forbearance and payment relief programs (application and supporting documentation typically required);

- Suspension of negative reporting to credit bureaus;

- Waivers of penalties and late fees;

- Mortgage modifications to reduce interest rates and monthly payments;

- Needs assessment and personal recovery plan;

- Contact a local HUD-certified Housing Counselor for free assistance in accessing these options.

- Charlotte Center for Legal Advocacy, along with statewide and national consumer organizations, continues to monitor changes in this area and will share updates as they come in.

- Have more questions? We’re here to help! Contact Charlotte Center for Legal Advocacy’s Consumer Protection Program: 704-376-1600