When Nicole’s grandfather told her about the Charlotte Expunction Clinic at the Mecklenburg County Courthouse, she didn’t know it would change her life. She had been carrying the weight of her past for more than a decade—over ten misdemeanor and felony charges that followed her everywhere, keeping her from opportunities she was working hard to earn.

At the Clinic, attorneys helped her file for expungement of the misdemeanors. A few months later, she received a letter in the mail: her record was cleared of them. The relief was overwhelming, but she wasn’t done yet.

With her misdemeanors off the books, Nicole then took her case to Charlotte Center for Legal Advocacy (Advocacy Center) to start the more difficult process of expunging her felony charges. The Advocacy Center represented her and helped her navigate the legal complexities, and one by one, her past felony convictions in Mecklenburg County were cleared. Cabarrus and Gaston Counties were next, and she wasn’t giving up.

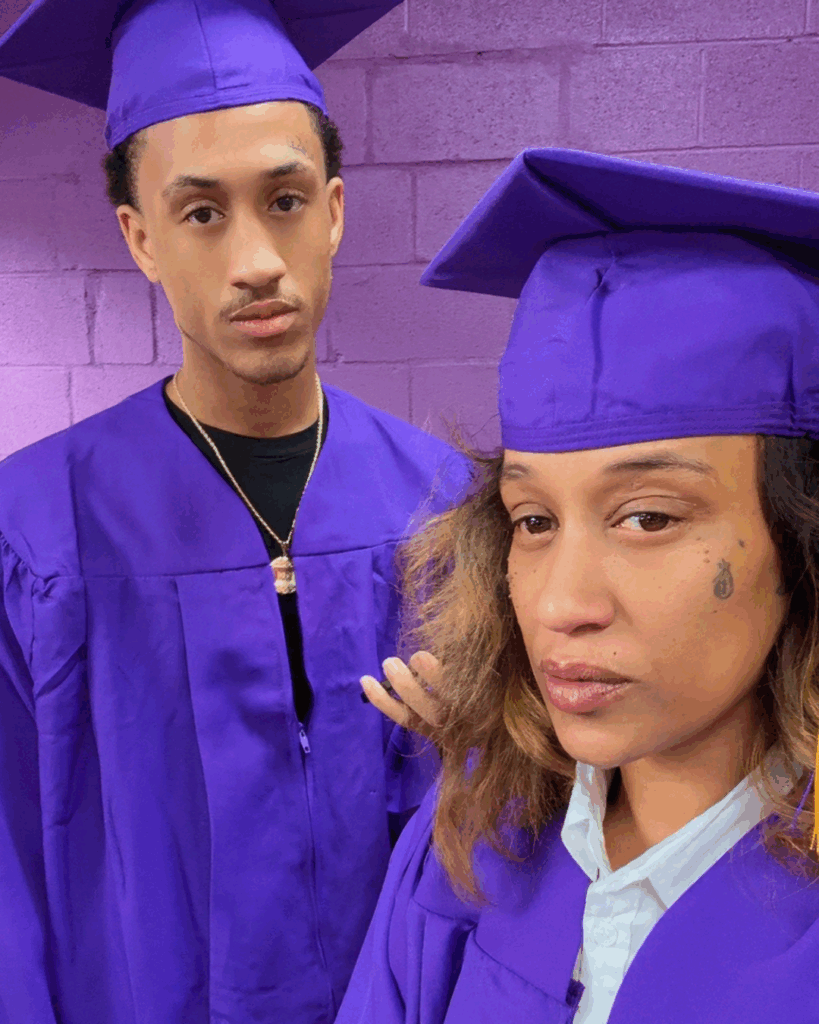

With her record no longer holding her back, Nicole’s life took a turn. Work became easier. She went back and finished high school. The impact rippled through her family—she challenged her oldest son, who had yet to graduate, to a race to see who could graduate first. They walked across the graduation stage together, a testament to perseverance and new beginnings.

For years, Nicole had been a Personal Care Assistant, limited by the charges that employers couldn’t see past. But now, she was free to pursue her passion. She earned her nursing degree as a Certified Nurse Assistant, and in March, she started a new position—one that reflects who she is today, not the mistakes she made over a decade ago.

“Some of us grow up, but the world won’t always let us,” Nicole says. “They only see our past mistakes. But thanks to the Advocacy Center, I can finally introduce people to the person I am now.”

With a clean background check and a new career path, Nicole is providing better for her family, proving that when given a second chance, people don’t just move forward—they thrive, inspiring others to do the same.